Post-Covid US retail market overview and trends

LFRA members were fortunate to have listened to multiple perspectives on the US retail market in the recent Overseas Study Tour to San Francisco and Los Angeles.

Presentations were delivered by Nick Nichles, Australian Consul General and Senior Trade & Investment Commissioner, San Francisco; CBRE San Francisco’s Alex Sagues, Vice President – Placemaking & Urban Retail and Matt Kircher, Executive Vice President & Managing Director – Big Box & Mall Retail Leasing; and Matt Garfield, Managing Director, FTI Consulting.

The four experts each shared their data and knowledge on the local landscape.

During the discussions members drew similarities between the US Large Format Retail market and the Australian Large Format Retail market, and their responses to COVID-19.

However, there were some unique challenges faced by retail in the United States we can learn from.

Painting the picture

The unemployment rate is higher than it was in the Great Recession.

US GDP is declining, and the inflation rate was 8.3% as of August 2022, compared to 6.8% in Australia.

Backtrack a couple of months and the 9.1% inflation rate in the US in June outpaced the 4.4% wage growth in Q2.

Alex Sagues, Vice President – Placemaking & Urban Retail, CBRE San Francisco shared with LFRA members that this lowered the personal savings rate to pre-pandemic levels, but it remained above levels leading up the Global Financial Crisis.

“Rising home prices are heading towards unaffordability for the average household in San Francisco.

“Intersected with household debt, this may limit access to housing,” added Mr Sagues.

The drivers of inflation include stimulus packages, increasing production costs, increasing petrol prices, government actions, and the Build Back Better plan – President Biden’s Jobs and Economic Recovery Plan for Working Families.

The Build Back Better plan was a $1.7 trillion package that proposed to fund an array of social investments during the pandemic, from lower education and healthcare costs to extending the expanded child tax credit.

Credit card debt in the US has skyrocketed since May 2022, and when people are near their maximum credit limit they make tough calls on essential and discretionary spend.

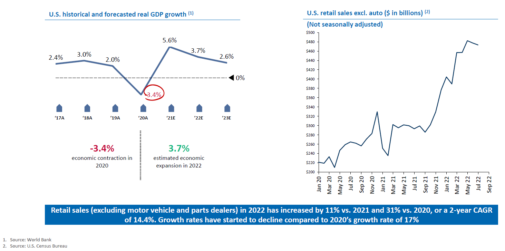

US economic growth has continued its spike through the beginning of 2022 but is expected to decline into 2023.

The US government provided targeted stimulus packages and tax credits during the pandemic which explains the spikes in retail sales in November 2020 and May 2021 in the graph below on the right.

Graphs produced by FTI Consulting

“Retail has continued its strong sales growth in 2022 as a result of reduced COVID mandates and continued use of financial relief packages”, explained Matt Garfield, Managing Director, FTI Consulting.

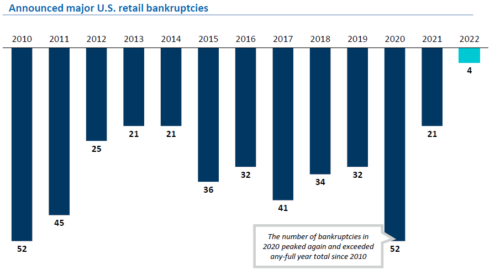

Retail bankruptcies in 2022 are at an all-time low due to the help provided by financial relief packages.

“More bankruptcies are expected as we get closer to the end of the year as many companies are at danger of default,” said Mr Garfield.

Graph produced by FTI Consulting

National retail availability is at a record low of 5.1% since CBRE began tracking in 2005.

Malls and lifestyle centres are the only categories gaining availability.

The retail development pipeline is stagnant due to elevated construction costs and a reduced investor appetite.

Resignations and job openings remain high, causing workforce disruptions and driving wage growth.

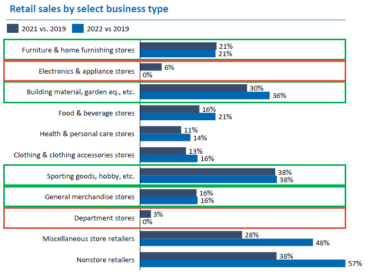

It was noted that the Large Format Retail categories in both Australia and the US saw an increase in share of overall retail sales during the pandemic.

FTI Consulting’s research demonstrated that categories such as furniture, home furnishing, and home improvement continued a sustained growth from last year.

Sporting goods and hobby categories retained their strong sales growth performance as well.

Graph produced by FTI Consulting

Overall, retail sales have continued their strong sales growth in 2022 due to reduced COVID mandates and continued use of financial relief packages.

Covid retail winners and losers in the US

Mr Garfield anticipates that many retailers are tightening their belt ahead of the holiday season and that 2023 is predicted to be much tougher.

“Mid-market brands are deteriorating, luxury brands are sustaining, and value shopping is growing,” explained Mr Garfield.

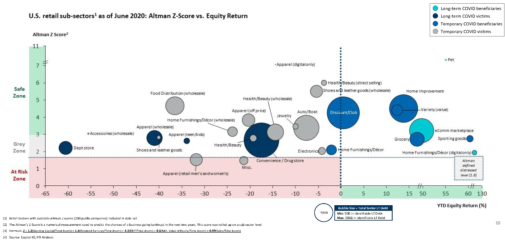

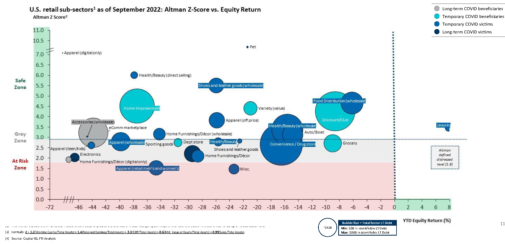

FTI Consulting observed the following retail winners and losers, with many similarities to the Australian market.

- Long-term COVID beneficiaries, with acceleration of growth

This group was defined as having an increase in equity value during COVID-19 with future upside anticipated from post-COVID behaviour.

- Home-related (digital only)

- Online Marketplaces

- Pet Food/Care

- Temporary COVID beneficiaries, with relinquished gains

This group was defined as having an increase in equity value during COVID-19, but recent gains may slow post-COVID.

- Discount/Club

- Grocery

- Home Improvement

- Sporting Goods

- Value-based merchandisers

- Temporary COVID victims, with current or mid-term recovery

This group was defined as having material dilution of equity value during COVID-19, but its underlying value remains.

- Accessories (wholesale)

- Auto/Boat

- Apparel (digital and off price)

- Electronics

- Health/Beauty

- Home-related

- Jewellery

- Wholesale Food Distribution

- Shoes

- Long-term COVID victims, with accelerated disruption.

This group was defined as having material dilution of equity value during COVID-19 with additional disruption anticipated post-COVID.

- Apparel (omnichannel and teen/kids)

- Apparel (wholesale)

- Convenience/Drug Stores

- Department Stores

It was observed that Covid-19 accelerated the decline of department stores, and that convenience/drug stores such as Rite Aid, CVS, and Walgreens are struggling to attract customers back to their stores.

People are continuing to purchase drug store products online, a habit that grew during the pandemic considering the heightened health risks and restrictions.

Mr Garfield believes that a vaccine roll out at local drug stores was their saviour during the pandemic.

In June 2020, FTI Consulting mapped retail sub sectors using both Z score and market returns.

11 of 28 sub sectors were in the ‘grey’ zone or ‘at risk’ zone.

Graph produced by FTI Consulting

Performance in 2022 has repositioned retail sub sectors into the red and grey zones.

Surprisingly jewellery is the only category that remains in the safe zone.

Graph produced by FTI Consulting

E-commerce was accelerated by Covid

It is not surprising that during the pandemic e-commerce outpaced core retail sales growth.

In the US, six years of e-commerce growth was experienced within the first 6 months of the pandemic.

Online retail sales growth (year on year) will decelerate to the high single digit or low double-digit range over the next few years.

This follows a steep increase during the pandemic, which saw a 13% year in year increase in US e-commerce sales in 2021 following a 26% increase in 2020.

“The e-commerce channel gained approximately 350 basis points of market share in 2020 and another 100 basis points in 2021,” said Mr Garfield.

“US e-commerce sales will top $1 trillion in 2023 compared to $500 billion in 2018.”

Amazon dominates e-commerce, with FTI Consulting estimating that Amazon’s share of US online sales is 44% and will plateau at 50% by 2030.

Graphs produced by FTI Consulting

In the US, retailers have resisted splitting ecommerce and store-based businesses, which they view as an integrated offering.

In fact, store opening announcements outpaced store closures in 2021.

FTI Consulting’s data is pointing towards a 33% projected retail online market share by 2030, compared to 17% in 2019 and 21% in 2021.

In terms of contactless payments made instore, Australian Consul General and Senior Trade & Investment Commissioner, Nick Nichles shared that Covid escalated the use of electronic payment systems.

35% of sales instore in the US are made via contactless payment. And there is also a transition towards card tipping in the US.

This share is increasing, however the US is lagging behind Australia’s uptake of contactless payment which is up to 95% according to Visa.

“Retail transaction systems are catching up to electronic payment technology, particularly with the roll out of Apple Pay,” said Mr Nichles.

“There is a contradiction of tech innovation and payment systems in the US.

“What is incredible is that Apple Pay was invented in San Francisco, but the availability of the technology in the United States is limited.”

Another contradiction is that people continue to pay rent and other expenses via cheque, but you can bank a cheque via an app.

Solving the last mile problem

“The e-commerce share of retail sales has stabilised and slightly declined since mid-2021,” said CBRE’s Alex Sagues.

“The high cost of shipping, third party logistics, and “free” delivery continues to buoy reliance on brick and mortar.

“Prior to Covid-19, trends indicated that more than 50% of customers preferred picking up online orders in store compared to other delivery methods.”

In Australia we call it “click and collect”. In America they call it “BOPIS”, buy online, pick up instore.

Ecommerce is more costly to service than brick and mortar, particularly with Amazon setting up the standard of a 2-day delivery for the industry.

US retailers are consistently trying to find new ways of eliminating costs of split shipment of goods from their distribution centres and stores.

“Autonomous electronic delivery is huge in California,” said Mr Nichles.

Solving that last mile problem of delivering products has become an increasing focus considering current economic factors such as increasing costs, increasing labour costs, and a shortage of labour.

“Retailers are looking at alternate delivery options where companies do not need to rely on people to make deliveries.”

The future for retail could include driverless or automated vehicles, with considerations such as autonomous and electronic vehicles, travel range and distance, a decreasing reliance on the road network, debated and trialed in the US retail industry.

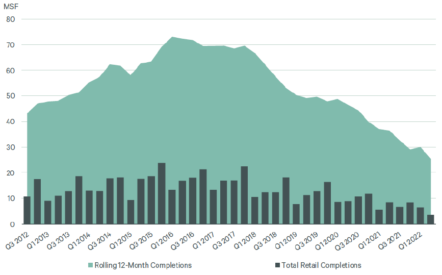

High costs and competition for labour keep construction pipeline lean

“San Francisco is the most expensive city to build,” confirmed Mr Sagues.

“A new retail centre has not been built in the Greater Bay Area in the past 7-8 years,” added CBRE’s Matt Kircher, Executive Vice President & Managing Director – Big Box & Mall Retail Leasing.

“Pre-GFC, retail projects were developed in was just the one build.

“Post-GFC, we are seeing retail developments completed in multiple phases.”

Retail completions totalled a record low of 334,450.9 square meters in Q2, down by 56% from a year ago.

“The drop in new development is largely attributable to rising construction material costs and competition for fewer available construction workers from other property sectors,” said Alex Sagues.

Increasing construction costs are putting pressure on builders and developers to complete the build if they have already begun.

However, because of the inflated costs, the same parties are unlikely to build anything else for some time.

Source: CBRE Research, Econometric Advisors | © 2022 CBRE Inc.

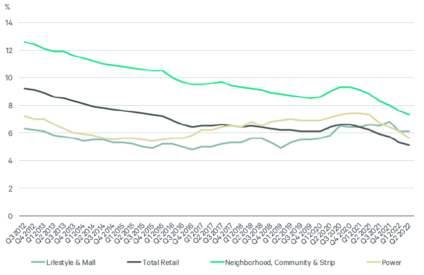

Retail and commercial vacancies in the US

CBRE’s research demonstrates that retail availability rate hit a new low of 5.1% in Q2.

The neighborhood, community and strip centre retail format has seen the biggest reduction in availability, down by 2.4 basis points over the past five years and 5.3 basis points over the past ten years.

Alex Sagues explained to LFRA members that the retail availability rate is low not because of the strength of retail but because there is not that many new retail being built.

Large Format Retail or homemaker centres are known as “power centres” in the United States.

Centres are typically 23,000 sqm to 56,000 sqm of gross leasable area and contain three or more LFR anchor tenants.

Technology companies are the slowest industry at encouraging employees returning to the office according to Australian Consul General and Senior Trade & Investment Commissioner Nick Nichles.

This is a stark contrast to the financial district in New York City who were the first to encourage staff to return to the office on a minimum of three days per week following lockdown.

There is currently a 38% occupancy rate of offices in San Francisco, which is impacting retail and other industries in the CBD.

Data from FTI Consulting shows that mall vacancy rates nationwide rose to 7.2% in Q3 2021, compared to a rate of 4.9%, pre pandemic in Q1 of 2020.

Matt Garfield used the example of 150 store closures for Bed, Bath and Beyond and 500 staff redundancies at GAP Head Office to demonstrate the dire situation for brands and stores usually seen in malls and shopping centres.

The mall footprint is declining and there are few new entrants to malls and shopping centres.

However, strip centres and power centres are driving growth in retail industries, with brick-and-mortar growth being driven by neighborhood centers, single tenant stores, and strip centres.

Source: CBRE Research, Econometric Advisors | © 2022 CBRE Inc.

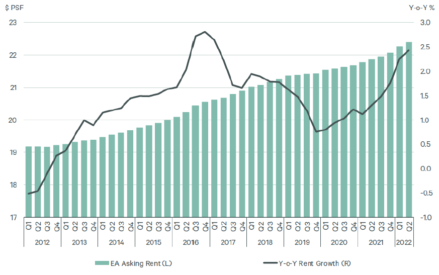

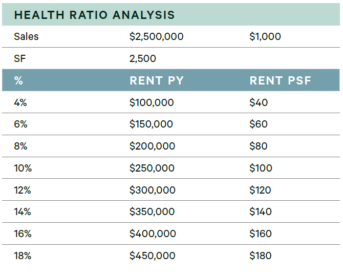

Shifting away from traditional leasing and rent deal structures

CBRE’s models show national rent growth for 2022 and 2023, although inflation could dull the relative growth levels (versus absolute dollars).

Average retail rent increased 2.4% year-over-year in Q2 to $22.39 per sqf.

This is the highest annual growth rate since Q1 2017.

“It is possible that inflation will negatively impact demand for space, curb expansion and subsequently impact rent growth,” said CBRE Vice President – Placemaking & Urban Retail Alex Sagues.

The only available space available for lease is existing space, considering that there are no new retail centres being built.

Matt Kircher explains that “A-grade”, or top performing Large Format Retail centres in the United States, are back to pre-covid rent levels.

Source: CBRE Research, Econometric Advisors | © 2022 CBRE Inc.

However, Covid was a major disruptor in the leasing market, with many arguing that it was for the better.

The US leasing market is moving away from fixed nominal deals towards a rent based on an agreed percentage of sales.

“Landlords who signed percentage rent deals before or during the pandemic are benefitting from high retail sales,” said Mr Sagues.

“Inflation will make this even more prominent, especially relative to assets with fixed rents.”

Anecdotal evidence suggests that rental rates are rising for both new leases and renewals, with some markets seeing annual increases of at least 4% for prime spaces.

It is important to note that rising inflation could spur higher rental rate increases as landlords face higher operating costs.

Table produced by CBRE

Chain operations impacted by cost inflation and supply shortages

Supply chain constraints continue to challenge availability of supply across the value chain, with retailers looking to find better ways of optimising distribution labour, technologies, and processes.

Retailers in the US are now experiencing excessive inventory holdings and are experimenting ways to better manage their distribution centre capacity to support excess inventory holdings.

In December 2021 and January 2022, retailers wanted to get ahead of the supply chain issues and bought big in anticipation of expected demand.

However the reality is that sales are shrinking and inflation is rising so consumers are not spending as much on discretionary goods.

“Automating processes in distribution centres is a hot topic,” said FTI Consulting Managing Director Matt Garfield.

“Distribution centres are usually located in high residential areas and there is usually a village or a collection of them in the surrounding area.”

Transportation and distribution costs declined from COVID peaks but are still high due to labour and fuel costs.

Labour shortages in particular are impacting retailers’ ability to scale up to meet peak demand in-store and online during the upcoming holiday season in November and December with Thanksgiving, Black Friday and Cyber Monday, Hanukkah, and Christmas.

FTI Consulting research shows that parcel capacity is constrained for many providers, adding risk to peak season delivery.

Retailers are revaluating transportation partners such as UPS, FedEx, and other service providers to identify lower cost solutions.

Retailers in the US are also pressured to leverage multiple distribution models to increase speed while minimising costs.

These distribution or delivery models to customers include Ship from Store, BOPIS (buy online, pick up instore), and BOSS (buy online, ship to store).

Buy online, ship-to-store (BOSS) is a purchasing method that lets consumers buy products online through a local store even when they are not in stock.

Instead of paying to have the products shipped to their address, the product gets shipped to their preferred store for free (usually), where the customer then picks it up.

Conclusion

LFRA Overseas Study Tour members appreciated the domestic economic and retail outlook provided by CBRE San Francisco and FTI Consulting.

It was a highlight for Mainbrace Constructions Business Development Manager Craig Dunlop, who shares his thoughts.

“If I look back at what I have been talking about most post-trip, it would have to be the shape of the US economy,” commented Mr Dunlop.

“Specifically, how businesses in the US are experiencing similar shortfalls to us here in Australia, including the difficulty in obtaining enough good personnel across all sectors.

“Both CBRE and FTI Consulting had really interesting insights and it was a great opportunity to hear their evaluation and predictions.”

This article is a part of a 10-segment series covering the 2022 LFRA Overseas Study Tour.